ERP – SAP FICO S/4 HANA (Live Online)

About Course

Unlock Advanced Financial Management with SAP FICO S/4 HANA Course

Embark on a transformative journey into the world of ERP with KAE Education’s SAP FICO S/4 HANA (Live Online) course. Spanning 48 hours, this course is meticulously crafted to build expertise in SAP Finance and Controlling (FICO) within the S/4 HANA environment, providing essential skills for modern finance and ERP systems. Led by seasoned instructors, this program balances in-depth theoretical knowledge with practical applications, preparing participants to manage financial processes, optimize reporting, and support strategic decision-making in the competitive landscape of ERP systems.

Key Highlights of the Workday SAP FICO S/4 HANA Course

(i) Duration:-

48 Hours (Live Online)

(ii) Delivery Mode:-

Interactive Live Sessions, Hands-On Labs, Real-World Projects

(iii) Requirements:-

Basic Knowledge of Accounting (Suggested)

(iv) Certification Preparation:-

Prepares you for SAP FICO S/4 HANA certification exams

(v) Target audience:-

consists of Business analysts, SAP consultants, ERP system administrators, finance professionals, and aspiring SAP Financials (FI) and Controlling (CO) experts.

Why Choose KAE Education for SAP FICO S/4 HANA Training?

KAE Education’s SAP FICO S/4 HANA course is designed with both practical and theoretical content to ensure a comprehensive learning experience. Here’s what sets this program apart:

(i) Live Online Instruction:-

Engage in interactive, real-time sessions with expert SAP Financials (FI) and Controlling (CO) instructors.

(ii) Comprehensive Curriculum:-

Learn both foundational and advanced aspects of SAP FICO in S/4 HANA, tailored to support dynamic financial and reporting needs.

(iii) Hands-On Labs:-

Participate in practical exercises, labs, and real-world projects to apply your knowledge directly to real scenarios.

(iv) Global Certification Preparation:-

Prepare for globally recognized SAP FICO S/4 HANA certification exams, positioning yourself as a qualified SAP Financials (FI) and Controlling (CO) expert.

(v) Career Advancement:-

Gain the skills needed for roles in Finance, Accounting, and SAP Financials (FI) and Controlling (CO) implementation, helping you excel in your career.

The Benefits of SAP FICO S/4 HANA Training

This training enables participants to effectively manage financial transactions, streamline accounting processes, and generate real-time reporting within the SAP S/4 HANA environment. Professionals with SAP Financials (FI) and Controlling (CO) skills are increasingly in demand, as organizations prioritize seamless ERP integration and informed financial decision-making.

(i) Master Core Finance Processes:-

Learn core financial operations, including General Ledger (GL), Accounts Payable (AP), Accounts Receivable (AR), and Asset Accounting.

(ii) Real-Time Reporting:-

Gain insights into SAP S/4 HANA’s advanced reporting features, enabling data-driven decision-making.

(iii) Financial Controlling Skills:-

Build competencies in Cost Center Accounting, Internal Orders, and Profitability Analysis, key skills for supporting strategic financial goals.

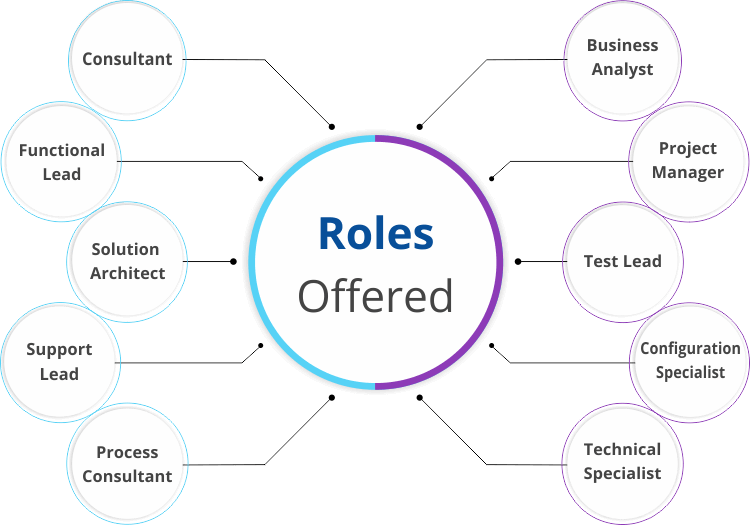

Key Career Roles After Workday SAP Financials (FI) and Controlling (CO) Training

Completing this course unlocks multiple career opportunities, including:

(i) SAP FICO Consultant:-

Assist companies in implementing and managing SAP FICO solutions.

(ii) Financial Analyst:-

Use SAP Financials (FI) and Controlling (CO) insights for budget planning and cost management.

(iii) ERP System Administrator:-

Oversee and maintain SAP systems within an organization.

(iv) Business Analyst:-

Interpret data and provide insights to improve financial performance.

Real-World Application of SAP FICO Skills

In today’s fast-paced Business environment, SAP FICO professionals can bring efficiency, accuracy, and innovation to organizations. This training ensures you’re prepared for real-world challenges, from optimizing financial workflows to aligning with compliance requirements.

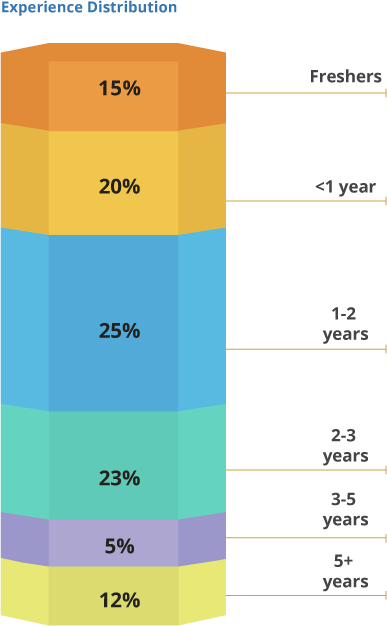

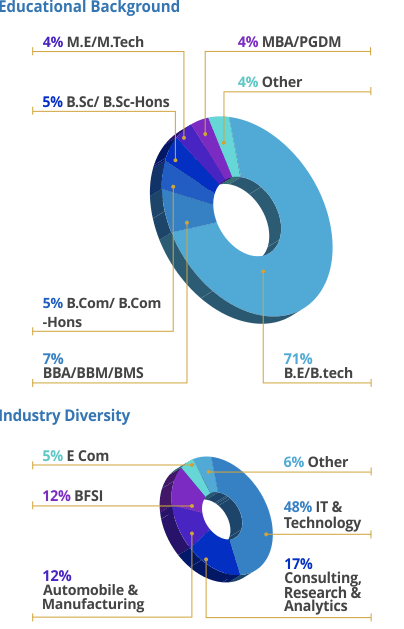

SAP FICO Batch Profile

Our students include freshers and experienced professionals from across industries, functions and backgrounds.

Sample Certificate

Frequently Asked Questions (FAQs)

Q1 : What is SAP FICO , and what are its main components?

A : Sap finance and controlling is a module in the SAP ERP system that handles financial and cost accounting. The main components of SAP FICO include General Ledger Accounting, Accounts Payable, Accounts Receivable, Asset Accounting, and Cost Element Accounting.

Q2 : How is SAP FICO integrated with other SAP modules?

A : SAP FICO is integrated with other SAP modules such as Sales and Distribution, Material Management, and Production Planning. This allows for seamless data flow and real-time reporting across different business processes.

Q3 : What is the fresher salary for the SAP FICO ?

A : An Entry Level SAP Fico consultant with around 2 years of experience can earn a salary of ₹4 Lakhs per year.

Q4 : What are the benefits of using SAP FICO ?

A : SAP FICO offers several benefits, such as improved financial visibility, automation of financial processes, real-time reporting, and increased efficiency in financial management.

Q5 : What are the primary transactions in SAP FICO ?

The main transactions in SAP FICO include creating financial documents, posting to general ledger accounts, creating vendor and customer master records, and creating and maintaining asset master records.

Q6 : What are cost elements, and how are they used in SAP FICO ?

A : Cost elements in SAP FICO are used to track the costs of a specific item or service. They are used in conjunction with cost and profit centers to provide detailed financial and revenue information for financial reporting and analysis.

Q7 : How is accounting for taxes handled in SAP FICO ?

A : By doing the sap financial accounting certification for taxes in SAP, FICO is handled by setting up tax codes and assigning them to different accounts. This allows for the automatic calculation of taxes during financial transactions and the ability to produce tax reports for compliance purposes.

Q8 : How do I start my career in SAP FICO ?

A : You can Take training in SAP FICO from the authorized center first. Learn the SAP FICO module on your own, and you can use practical training to learn everything. Then after completing the training, you can search for a related job.

Q9 : Why should you Learn SAP FICO ?

A : SAP FICO is a necessary SAP ERP module, mainly used for financial management in the market, so you will have multiple career opportunities for having skills in the SAP Fica module.

Course Content

Module 1: Introduction to SAP S/4 HANA

-

Overview of SAP S/4 HANA

-

Key Features and Benefits

-

Transition from ECC to S/4 HANA

-

Overview of ERP: History, Major Packages, and Advantages